Image by Mariana Anatoneag

What is the meaning of this statement?

"Yes, debt is an essential part of running organizations, but as per data out there, the overall corporate debt load in the US alone is around 11 trillion dollars, and we still see companies having valuations that is not matching with the fundamentals in terms of profit or revenue. Is it what we would like to see in a corporate world? Moreover, such practices could create an environment where powerful corporations could become even more powerful preventing any upcoming organizations with integrity focused values to come up."

Here is one simple case study:

As per intelligence search platform sites out there (sites similar to those that rarely make money, but given financial valuation and power beyond grasp for thinking brains), this selected company is listed with the following revenue.

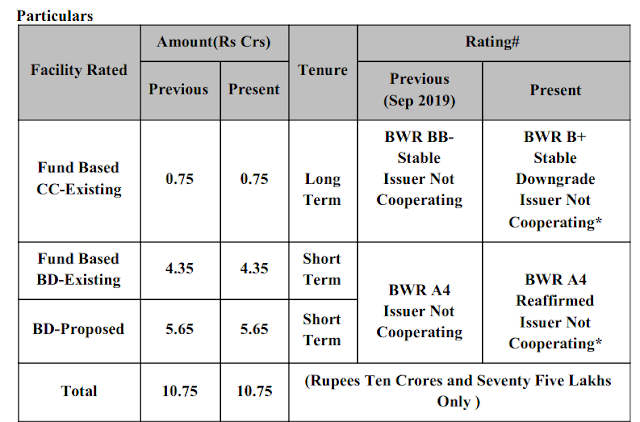

What is the real financial picture of this company?

These numbers are in Rupees with an exchange rate of $1 to around Rs 65 in 2016/2017, and ~Rs 75 in 2020/2021.

What can we infer from this data?

Here is one other detailed report on valuation of another company that is roaring nowadays -

https://ethz.ch/content/dam/ethz/special-interest/mtec/chair-of-entrepreneurial-risks-dam/documents/dissertation/master%20thesis/MasterThesis_Shi.pdf

Do you know what percentage of startup companies file for bankruptcy?